Research

I am currently an Assistant Professor in the Department of City and Regional Planning at the University of California at Berkeley and the Faculty Research Advisor for the Terner Center for Housing Innovation. My research focuses on housing, community development, urban poverty and inequality, the Community Reinvestment Act, and access to credit and homeownership. The following are some of my research projects:

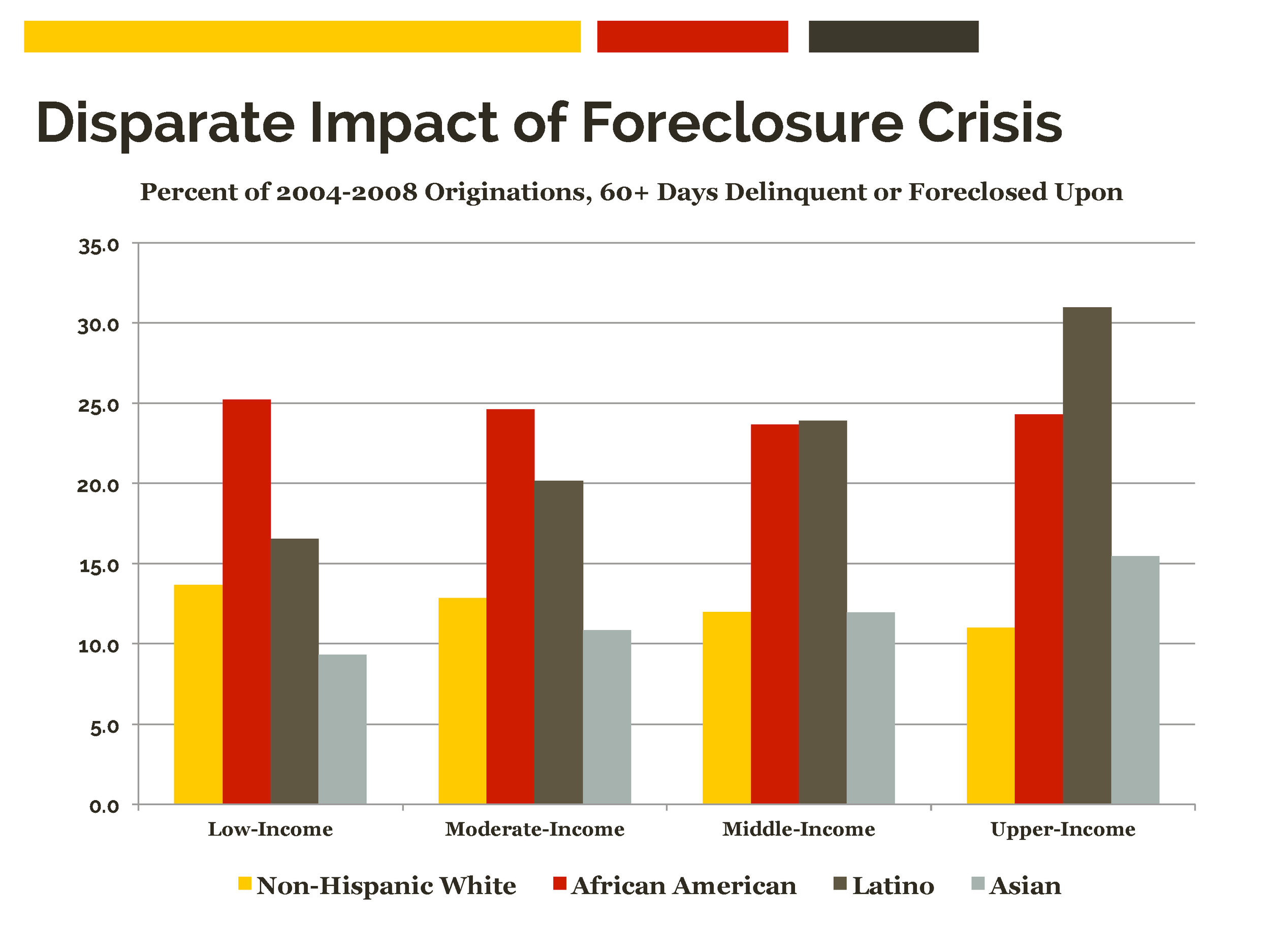

THE IMPACT OF THE FORECLOSURE CRISIS ON COMMUNITIES OF COLOR

Dia de Los Muertos Alter, Fruitvale, 2014 (Photo credit: Reid)

The foreclosure crisis disproportionately affected African American and Latino borrowers and communities; 1 in 4 Black and Hispanic borrowers who bought during the height of the subprime crisis lost their homes to foreclosure. My research seeks to understand the causes of this disparate impact, the experiences of low-income and minority borrowers during the subprime boom, and the long-term implications of the subprime crisis for the racial wealth gap. I am also conducting research to understand the implications of the crisis for all lower-income neighborhoods: how have nonprofits used the Neighborhood Stabilization Program to redevelop foreclosed properties for affordable housing? Which neighborhoods are rebounding, and which are being left behind?

THE COMMUNITY REINVESTMENT ACT (CRA) AND ITS INFLUENCE ON COMMUNITY DEVELOPMENT

Passed in 1977 in response to concerns over redlining, CRA requires that federally insured banks and thrifts meet the credit needs of the communities that they serve, including low- and moderate-income neighborhoods. While much of the attention on CRA focuses on the mortgage lending activities of banks, the law actually catalyzed a much larger role for banks in community development. Today, CRA directs an estimated $125 billion dollars in private loans, investments, and grants to low- and moderate-income borrowers and communities each year, in areas as diverse as public housing, financial counseling, commercial corridor revitalization, education (including funding pre-school and charter school facilities), and public health. In this project, I dig deeper into the intent, implementation and impact of CRA. How can CRA be understood within the context of the broader retrenchment of the welfare state? What are the implications of CRA for the field of community development? Does CRA contribute to the well-being of lower-income communities, or is it the mechanism by which neighborhoods—under the guise of “reinvestment”—are primed for new waves of speculative capital? These questions are particularly salient in the wake of the subprime crisis, as stakeholders on both sides of the aisle are debating the relative merits of CRA and proposing to either revise or abolish the regulation.

ACCESS TO CREDIT AND HOMEOWNERSHIP

Beginning with the residential security maps from the Home Owners Loan Corporation that redlined predominantly minority neighborhoods, housing finance policy has long been shaped by definitions of risk that in turn influence who has access to credit and at what cost. My research explores how the social construction of risk contributes to inequalities in the mortgage market. How do definitions of risk and the evolution of mortgage finance products and regulations shape access to credit? How can we design a more equitable housing finance system that meets the needs of historically underserved borrowers?

Source: Lost Ground, 2011. Center for Responsible Lending.

Exploring the Relationship between Place-Based Investments, Neighborhood Change, and Economic Mobility

Recent events in Ferguson and Baltimore have led to a resurgence of interest in the role of place in shaping income inequality and the lack of economic mobility among poor and minority households. Patrick Sharkey’s Stuck In Place vividly captures how generations of African American families have become immobilized, living in neighborhoods isolated from economic opportunity as the result of a complex constellation of factors, including the legacy of housing, education, employment, and incarceration policies.

But what happens when public and private investments are directed to these communities? Do policies that seek to reinvest in poor, urban neighborhoods—to re-establish opportunity and revive private market investment—improve the landscape of opportunity for the urban poor? Or do they fail to address the structural causes of poverty —as many critics contend— and merely push the poor out to other disinvested places as wealthier households move in? Despite decades of public and private sector efforts to revitalize low-income communities, it’s still unclear whether and how place-based initiatives transform neighborhood conditions, and even more importantly, improve the lives of families living there. With newly collected data on one such place-based effort, HOPE IV, I seek to assess whether large-scale investments like this lead to neighborhood improvements, and if so, under what conditions?

The demolition of CJ Peete, one of the New Orleans HOPE VI public housing projects (Photo credit: Shawn Escoffery)

The Rental Assistance Demonstration

In 2012, the Department of Housing and Urban Development launched the Rental Assistance Demonstration (RAD) program, designed to revitalize and preserve the nation’s public and assisted housing stock. The program allows local public housing authorities to convert public housing properties to project-based Section 8 Housing Assistance Payments (HAP) contracts, which gives housing authorities the ability to access new sources of capital to put towards the renovation and preservation of affordable units.[1] It also transforms the way in which public housing operates, shifting the financing and management of units from the housing authority to a model based on public/private partnerships with affordable housing developers (both nonprofit and for-profit entities). While a large number of housing authorities across the country are participating in RAD, a few cities across the country are undertaking RAD conversions on their entire portfolio of public housing, offering a unique opportunity to study the implementation and impact of the program on the future of public housing. In this research project, I am conducting case studies of cities that have undertaken portfolio conversions of their public housing stock. Specifically, this project will analyze the experiences of public housing authorities that have made the decision to convert their public asset portfolio to RAD. What has been their experience with RAD implementation? How does RAD influence the financing and sustainability of public housing? And what is the impact of RAD on public housing residents?

[1] RAD also entails a second component, Rent Supp, RAP, and Section 8 Mod Rehab Housing (which is not part of this evaluation). This second component allows Rent Supplement (Rent Supp), Rental Assistance Payment (RAP), and Mod Rehab properties to convert their tenant-based vouchers, which are issued upon contract expiration or termination, to project-based Section 8 assistance.